How I Learned to Stop Worrying and Love the Market

Haven’t You Heard? Azura Is Making Competition Free Again.

If you’re under 30, the old playbook is obviously dead.

“Get a degree, get a job, save, buy a house” now reads like advice written by someone who bought their first home for $180k and thinks inflation is a conspiracy theory. People call the resulting mood “financial nihilism.”

I think it’s a rational response to incentives.

A Premise, Not a Pitch

This is the context Azura was built in.

Azura is a zero-fee onchain trading platform — not “discounted fees,” not “rebates,” not some membership perk — zero trading fees.

Not because it’s cute, and not because I’m pretending to be altruistic. It’s because if onchain markets are the furthest point on the risk curve, compounding house edge is the most corrosive tax imaginable.

You shouldn’t be paying an invisible toll just to compete.

The rest of this post explains why.

The Origin Story

When I was 11-years-old, I asked my father what job would make me the most money right out of college. I asked because I noticed we had financial issues, and I didn’t want to grow up thinking money was optional. He told me to become an investment banker.

So from that day forward I dedicated my life to finance and economics. Like most Gen Z kids, I took to the internet, and the internet did what it always does: it exposed me to markets long before anyone thought I was old enough to understand them.

I traded (and gambled) CS:GO skins and TF2 hats, flipped sneakers, resold sneaker bot license keys, bought (too little) BTC, arbitraged video game license keys, lost money trading 0DTE options, became an XMR maxi, did RWT in Runescape. You name it.

At the time it felt like being an online degenerate. In hindsight, it was early exposure to something most people don’t understand until they’re 40: markets are the only game that matters.

Only recently did I start asking why so many people in my generation developed the same instincts. Why do so many of us feel like we’re racing to board the remaining financial lifeboats, like a clock is ticking and the time to make money is now?

Because the clock is real.

/r/wallstreetbets subreddit logo

Generation Z: The Last Generation in the Alphabet

There are a lot of explanations floating around for why Gen Z feels like this. Some call it “financial nihilism,” as if it’s a psychological defect. Some blame Boomers. Some blame AI. Some blame social media.

I don’t really care what you want to blame. The incentives are what they are.

Here’s the environment we’re in:

2025 US college grads have a 9.3% unemployment rate, higher than during the GFC

The top 1% of households own nearly 30% of the country’s total wealth

The average first time home buyer is now 40-years-old

The US dollar has lost ~91% of its value since 1960

That environment doesn’t produce “nihilism.” It produces rational repositioning.

If the expected value of the traditional path collapses, people move further out on the risk curve. Not because they’re delusional, but because they can do basic math.

And what’s funny is how aggressively older generations refuse to acknowledge this. They act like anxiety is a cultural contagion, when it’s mostly just people noticing that the ladder is being pulled up faster than they can climb it.

Amazon fulfillment center in Tijuana, Mexico

Capitalism Without Competition Is Extraction

Darwinism and capitalism both rely on competition. The environment rewards fitness, skill, adaptation. Adam Smith’s whole framework assumes that competition drives efficiency and innovation.

That only works when competition is real.

Most modern markets aren’t competitive anymore. They’re captured. They’re gated. They’re dominated by intermediaries whose main talent is extraction. They’ve turned the “game” into a set of toll booths.

Education is a toll booth. Housing is a toll booth. Healthcare is a toll booth. Labor markets are increasingly a toll booth.

People pretend it’s still meritocratic because admitting otherwise would be psychologically catastrophic.

The result is that effort and reward are no longer tightly coupled. The traditional “work hard and you’ll be fine” narrative collapses once enough people realize the ladder is being pulled up faster than they can climb.

Once you see it, you can’t unsee it.

So naturally, people start searching for the remaining arenas where competition still exists. Markets that are young, chaotic, and open. Markets where positioning matters more than credentials. Greener and freer pastures.

Random meme I found on Twitter, OP unknown

The Furthest Point on the Risk Curve

Crypto isn’t morally superior. It’s structurally young, inefficient, and still accessible.

Traditional financial markets are institutional, efficient, and tightly controlled. If you’re young, smart and ambitious, the “safe” path is basically: take a job, collect wages, invest in the S&P, and hope inflation doesn’t eat your future faster than your savings can grow.

That isn’t a compelling proposition.

Onchain markets are volatile, chaotic, often predatory, and filled with behavior that would get you institutionalized in any normal industry. But they still do one thing legacy markets have largely stopped doing: they allow real asymmetry for individuals.

Anyone with conviction and early access can still leapfrog decades of savings in months. We’ve watched it happen repeatedly. PEPE, WIF, HYPE, LIT, countless others

It’s the only market on the planet where scams like LIBRA are publicly projected on a world stage as $300m in investments are wiped out, and where we can watch tokens like TRUMP rip from $1b to nearly $80b in a matter of hours..

TRUMP Memecoin Launch Post on Truth Social

Prior generations totally dismiss this. Not only that, but memecoins have been pronounced dead about a million times in the last 3 years, perps and prediction markets are just “gambling”, and onchain is routinely declared a failed experiment by people who remember where they were on 9/11.

Try to describe Hyperliquid or Polymarket to anyone not in the industry. To them, you’re going to sound like the Uber driver who put their life savings in XRP. You might as well be telling people about how harmless heroin is so long as you use different veins each time you shoot up.

People love to dismiss this as gambling, but they’re missing the point. The entire reason it works is because the market is still open. It’s still inefficient. It still rewards speed, research, and risk tolerance.

And if you’re young, “open” matters more than “safe.”

Onchain is the furthest point on the risk curve. The furthest point West. The greenest and freest pastures.

Succession, 2018

The Quiet Tax

Most traders assume volatility and scams are the real enemy.

They’re wrong.

Volatility is obvious. Scams are known problems. Everyone understands those risks. The real killer is quieter: compounding platform fees.

Let’s take a quick look at platform fees generated since Q1 ‘24:

Photon: $442m

Axiom: $375m

Trojan: $280m

BullX: $204m

+ over $700m from many others…

All-in-all, roughly $2,000,000,000.00 has been extracted from onchain traders. And these are just the numbers that are available to us for trading bots. Where exactly has it gone?

Average onchain trading experience

House Edge and Capital Decay

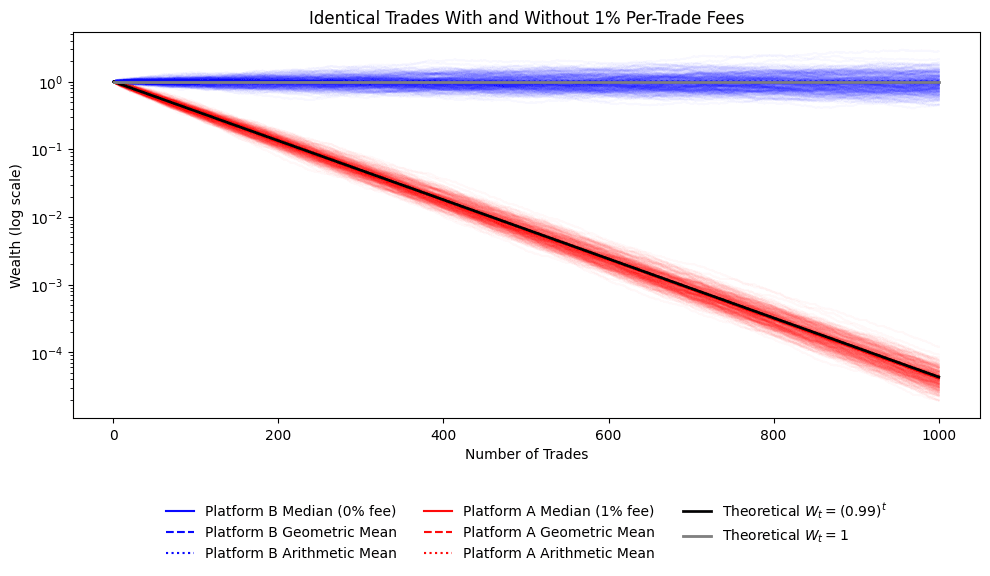

A 1% fee per trade doesn’t feel like much, which is exactly why it works. It’s the perfect tax. Small enough that nobody complains, brutal enough that it compounds into guaranteed capital decay over time.

Here are a couple fun facts:

A 1% fee cuts your capital in half every ~69 trades:

(0.99)t=0.5t69

Over 1,000 trades, a trader paying 1% has roughly 23,000× worse odds than the same trader paying zero fees:

W1000(0%)W1000(1%)=1(0.99)100023,000

Here’s a graphic visualizing the phenomena:

In short: you have exponentially worse odds paying 1% each trade, contrary to what the KOLs paid to say otherwise may claim. Fees imply almost-sure capital decay.

With odds this bad it’s no wonder you’re still trading.

Azura: Make Competition Free Again

This got me to ask a simple question:

If you’re trading at the furthest point on the risk curve, why are you paying a compounding house edge just to participate?

Azura is our answer.

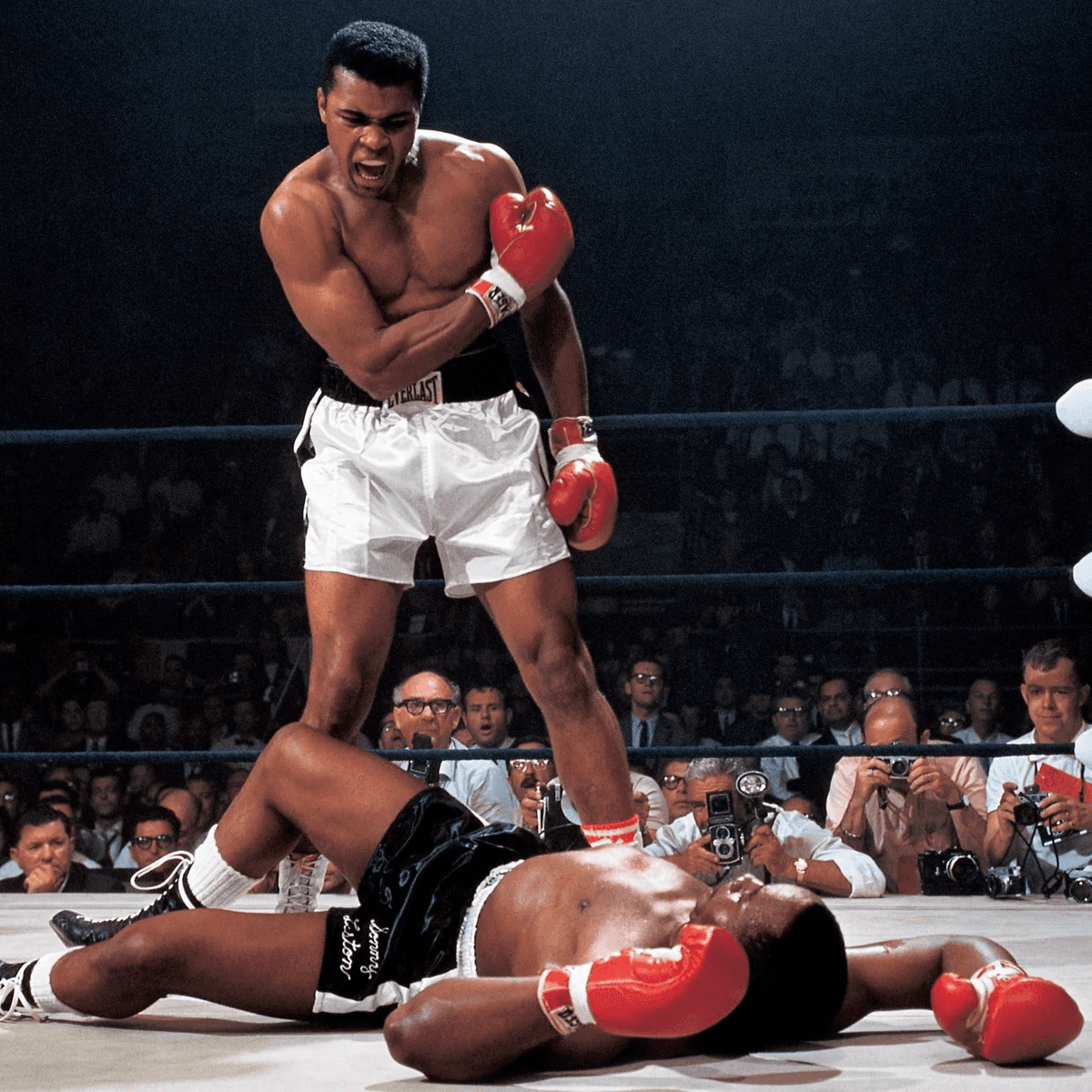

Muhammad Ali and Sonny Liston, 1965

We built Azura around three things that should’ve been obvious years ago:

Competition shouldn’t be taxed.

Trading is already hard enough. If you’re taking the risk, you should keep the upside. Azura charges zero trading fees — not “discounted,” not “rebated,” not some membership-gated tier. Zero.

Discovery shouldn’t be manual.

Onchain markets move too fast for curated lists, and firehose feeds are just noise. We built the first algorithmic token feed — ranking tokens using real market signals so you see opportunities before they become obvious.

Capital shouldn’t be fragmented.

We built USD abstraction — you can trade with USD across supported chains without holding gas tokens, bridging manually, or dealing with fragmented balances.

That’s the product.

We monetize in ways that don’t degrade execution quality and aren’t adversarial to the user: RPC kickbacks, orderflow rebates, backrunning (on/offchain pool arbitrage), and node operating. None of these require us to overcharge, worsen fills, or quietly stack the odds against you.

Trading is still trading. We’re just removing the toll booth. If you’re going to take risk, you deserve a platform that isn’t quietly bleeding you dry.

We refuse to punish people for competing.

If you’ve ever felt like you were fighting an invisible tax while trading, you were. With Azura, that ends.